ΣΧΕΤΙΚΑ ΑΡΘΡΑ

Dr. Γιώργος Αθανασάκος: Πρέπει να δημιουργηθεί νέα αξία στην Ελλάδα- Ποιες ελληνικές μετοχές ξεχωρίζει

How can Greece attract investment by creating value? What are the major challenges for Greece and the world in 2023 and do the special international conditions leave room for returns?

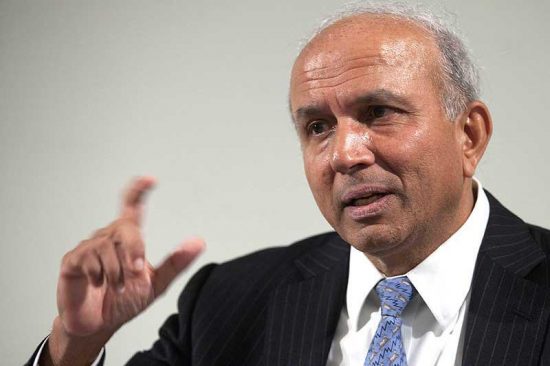

Dr. George Athanassakos Professor of Finance and Ben Graham Chair in Value Investing at the Ivey Business School, set the tone of a new difficult era for markets as a result of international developments.

Dr. George Athanassakos, for whom the acquaintance with Prem Watsa the CEO of Fairfax Financial Holdings was a turning point in his life, notes that the strong average nominal and real stock returns of the last 30 years are not going to be repeated, or even come close in the next 30 years.

He speaks exclusively to www.mononews.gr about the need to create new value in Greece, for the great challenges of 2023 in a difficult economic environment and underlines that there are opportunities for healthy returns but are hidden in individual company cases.

Events in Ukraine usher in a new Cold War and will challenge globalization. But individual stocks could do well and the key to outperformance will be proper stock selection and fundamental analysis. As he emphasizes, he is concerned with the long-term upward trend of inflation and interest rates, which he connects with the prevalence of international protectionist and cold war tendencies and de-globalization. However, he notes that good, well managed, Greek companies and their stock might continue to do well regardless of what the market as a whole does.

What’s your prediction or the perspectives of the markets, in US and Europe going forward? (Challenges, risks or positive factors)

In my opinion, the secular trend toward globalization has ended with predictable adverse (long term) effects on inflation, and interest rates, as well as on bonds, real estate and stocks. It is the long run, not the short run (business cycle), effect on inflation, interest rates and financial markets that concerns me.

Notice the similarities with previous end-of-era periods of globalization: a pandemic that has been likened to a war, challenges to globalization by large players such as Russia and China, and rising protectionism, economic instability, and galloping inflation. Covid-19 has bought forth a new wave of nationalism in the world with industries moving back to their home countries as seen with Japan and the US. Moreover, China, Russia and India are challenging globalization. Finally, wars tend to lead to an end of, or challenges to, globalization. The events in Ukraine are auguring a new Cold War and will further challenge globalization.

All these do not augur well for the financial markets.

The hefty average nominal and real stock returns experienced over the last 30 years are not going to be repeated, or even come close to, in the next 30 years. On average, stock returns will be nothing to write home about. This does not mean that individual stocks will not do well. Stock picking and fundamental analysis will be key to outperformance going forward.

Is Greece now attractive as an investment destination? Which are the pro and cons. Is there any crucial changes that you think as important to that?

Markets hate uncertainty. An investor wants to make a profit and increase value from his/her investments. So what they do is they project cash flows from investments and discount them to the present by an appropriate discount rate. Uncertain government policies and unpredictability affect cash flow projections and the discount rate leading to lower present values and eventually value destruction that turns away investors. So while on one hand, the crisis of the last 10+ years has given the impression and appearance of great investing opportunities in Greece, this may not be the case after careful examination of risks and rewards.

Value destruction has been a perennial problem for Greece. We need political stability, fewer demonstrations and road blockages/closures, public safety, and regional stability. None of these is happening right now and none of these will change going forward.

There is currently some investment activity in Greece. But this in my opinion is not investment in new ideas and new companies, but rather selling off existing infrastructure to foreigners. This will affect adversely future generations.

Greeks may also appear to be doing well now as they keep selling their land, a lot of it to foreigners, but what will happen to the next generation which may have nothing to sell?

So we need new ideas and companies being created by Greeks who are committed to Greece. We must encourage Greeks living and working overseas to return to Greece. Give them incentives to return, such as, for example, no taxes for the next say five years. These people will not only bring in money and expertise but also a different way of doing business and more professionalism in carrying out their affairs. Greeks have left frustrated in recent years as they see not future in the country that offer no meritocratic opportunities and a crashing bureaucracy. These have to change.

Other suggestions that have been also offered by others are: Combat rampant tax evasion, simplify the tax system and give tax incentives for investments in emerging sectors and technologies, severalty penalize corruption and hush money, clean up and modernize the public sector and offer public services over the internet.

At this point, I think tourism is out strongest card, but we may be screwing up things there too. Uncontrolled, low quality, tourism does not help. We must raise the bar with increased professionalism in the sector and improve the quality of the experience. We may also need to limit the intake of tourists as at some point there are negative returns to tourism, if villages and beeches are over run with tourists who seek a cheap touristic experience.

As a value investor have you invested in Greece? Which sectors you see as more interesting? Or which companies? What do you think on Greek stock market?

-I have never invested in Greece. Sometimes because I did not trust the governance of the Greek companies, other times the transparency of financials, but most importantly because the Greek stock market is quite thin with family controlled or closely held businesses for which one needs to have boots on the ground to get to know the business and the people running the business. And I have lived in Canada for 40 years now. But this does not mean that there are no individual companies that are worth looking into. Having met the Aegean Founder and Chairman Mr. Vassilakis when he was a speaker at my conference in Athens, I was very impressed by him, his professionalism and straight talk, and would be happy to mention Aegean as a company of interest, even though airlines are not the best business to be in. Also, Jumbo seems to be doing the right things by dominating the Greek market in its sector. It is a family business and while there may have been some governance issues, family business run by capable managers like Mr. Vakakis, tend to be very attractive investments. Eurolife, Eurobank and Mytilineos are also in my list of worthwhile companies given their management team and, especially, because of Fairfax involvement with these companies. In the face of the higher than historical inflation and interest rates I expect for the future, and increased volatility in the financial markets, I like to invest in good quality countries and good quality companies and to get to know companies inside out. I am afraid that Greece and Greek companies, on average, may experience some difficult times. Nevertheless, good quality Greek value stocks may still do well even if the market as a whole may not.

Does the uncertainty about the Greek elections results, influence investors behaviour this year?

Absolutely! Uncertainty about government policies is the worst enemy of investing. Unpredictable governments and government policies make investment projects fail. And we have plenty of evidence of this in Greece. Markets like the business friendly policies of conservative parties as their aim is to make the pie larger as opposed to keeping the size of the pie the same and trying to re-distribute it. Entrepreneurship and wealth creation must be encouraged not stifled by government bureaucracy.

How do the energy crisis, the energy transition wave and esg influence the values, the returns, and the investment choices you make

Years of underinvestment in the oil & gas industry, heavy regulation and the ESG craze have shifted not only the oil price dynamics, but also that for all commodities. For example, mining companies are returning capital to investors rather than invest to increase production out of fear of ESG regulations. This implies major shortages in metals down the road at a time when demand will be increasing due to renewable energy and electric vehicle production. This implies higher prices going forward for these commodities, over and beyond the next business cycle.

How Benjamin Graham theory has influenced your thought and choices. As a professor are you an investor to?

Emotions cloud one’s decision-making abilities in investing. Investors need to learn to control their emotions or train themselves to control their emotions. For example, we must never make impulsive decision; think of the opposite; have an analytical approach that prevents emotions from overwhelming us; have check list of what good companies should have to be attractive; and have a mentor. As Aristotle said: The aim of the wise is NOT to secure pleasure but to avoid pain. Avoiding pain is key to value investing as we would rather minimize risk than max return.

You can be the best valuator, the best screener, etc but if you panic, you get greedy and you are impatient you will never be a good investor. Also, if we do not do our homework and if we are not independent you will never be a good investor. No one is watching our back that is our job. Best investors understand human nature and institutional biases.

Unfortunately, value investing is not taught at Universities, which instead teach modern portfolio theory that can not be more different than value investing.

After finishing the graduate program, I realized I had the right character to be an investor, but I did not have the right process. I had the character of a value investor, patience, discipline, long term perspective, but I did not know what value investing was. A big milestone in my life was when I met Prem Watsa, the CEO of Fairfax Financial Holdings. He introduced me to other value investors and via my talks with them and Prem I realized that I was a value investor and started to learn and understand the process. And so, I became an investor with a process. This has benefited tremendously my own investments. In my opinion, stock picking (value investing in particular) works, one just needs to have the right process and the right temperament.

George Athanassakos-Who is Who

Born in Greece.

Dr. George Athanassakos is a Professor of Finance and the Ben Graham Chair in Value Investing at Ivey Business School, which he joined in July 2004. He is also the Founder & Managing Director of The Ben Graham Centre for Value Investing, which he launched in 2006, and the Founder and Managing Director of the Center for the Advancement of Value Investing Education, which he launched in 2008. Prior to joining Ivey, Dr. Athanassakos spent a number of years first as a researcher and then as the Chief Economist of a major trust company in Canada, and taught at York University and Wilfrid Laurier University, where he was professor of Finance and Founder & Director of Laurier’s Financial Planning Program. He has a BA in Economics and Business Administration from The University of Macedonia, Thessalonica, Greece, and an MA in Economics, an MBA and a PhD in Finance from York University. The Financial Planning Standards Council has bestowed Dr. Athanassakos with the FP Canada™ Fellow distinction for his outstanding contribution to furthering FPSC’s mission and for advancing the financial planning profession. Dr. Athanassakos is also a Fellow of the Quality Shareholder Initiative at the Law School of George Washington University in Washington, DC. He is the only Canadian to receive this distinction. Dr. Athanassakos’ contribution to value investing was honoured by Woxsen University which has established the George Athanassakos Chair in Value Investing.

Dr. Athanassakos has been ranked among the top 10 researchers in Canada by research published in Financial Management and among the top 10 Canadian professors by the Globe and Mail. He has researched extensively the institutional attributes of the Canadian capital markets, the effect institutional trading and analysts’ forecasts have on stock market performance, stock and bond market anomalies and bond and equity valuation issues.

Dr. Athanassakos has published in numerous academic journals including Journal of Banking and Finance, Applied Financial Economics, Journal of Business Finance and Accounting, Journal of Financial Research, Financial Analysts’ Journal, Canadian Journal of Administrative Sciences, Journal of Economics and Business, Review of Financial Economics, Multinational Finance Journal, Advances in Futures and Options Research and others. His books include Derivatives Fundamentals (available through the Canadian Securities Institute), Equity Valuation: A Guide to Discounted Cash Flow and Relative Valuation Methods and Value Investing: From Theory to Practice – A Guide to the Value Investing Process. Dr. Athanassakos has also written articles for the Financial Post and MoneySense magazine and currently writes, as a guest columnist, about investments and economic and financial topics in The Globe and Mail, Canada’s largest daily newspaper, and the Canadian Investment Review.

The chair he holds has been endowed by Mr. Prem Watsa who also supports his activities in Canada and in Greece, where ha has recently established the Greek Centre for Value Investing to educate Greeks about value investing through conferences (next one is scheduled for October 13, 2023 at Bodosakeion Megaro, Athens), seminars (next one scheduled for September 25-29, 2023 at Bodosakeion Megaro, Athens) and teaching Value Investing at the University of Athens (EKPA).

ΕΙΔΗΣΕΙΣ ΣΗΜΕΡΑ

- Scrip dividend για κεφάλαια έως 30 εκατομμύρια ετοιμάζει η Briq Properties

- Δήλωση Στουρνάρα στο mononews: Τι φέρνουν οι δασμοί Τραμπ στην παγκόσμια και ελληνική οικονομία

- Στάσσης: Πώς οι επενδύσεις 12 δισ. στη Δυτική Μακεδονία θα μεταμορφώσουν τη ΔΕΗ και τη χώρα

- Δίκη Γκότση-Κουτσολιούτσου-Σάκκου: Σήμερα η τελευταία δικάσιμος για την αργοπορία αναστολής διαπραγμάτευσης της μετοχής